Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.

Experts are constantly updating and revising their forecasts, so here’s the latest on two of the biggest factors expected to shape the year ahead: mortgage rates and home prices.

Will Mortgage Rates Come Down?

Everyone’s keeping an eye on mortgage rates and waiting for them to come down. So, the question is really: how far and how fast? The good news is they’re projected to ease a bit in 2025. But that doesn’t mean you should expect to see a return of 3-4% mortgage rates. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

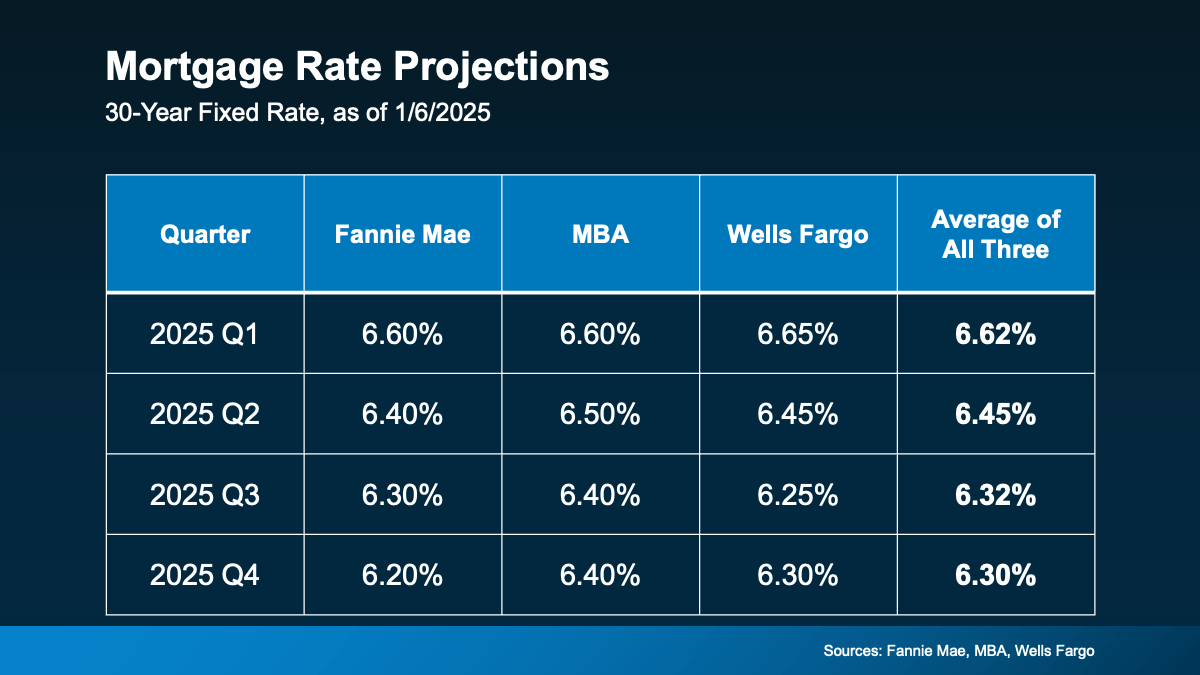

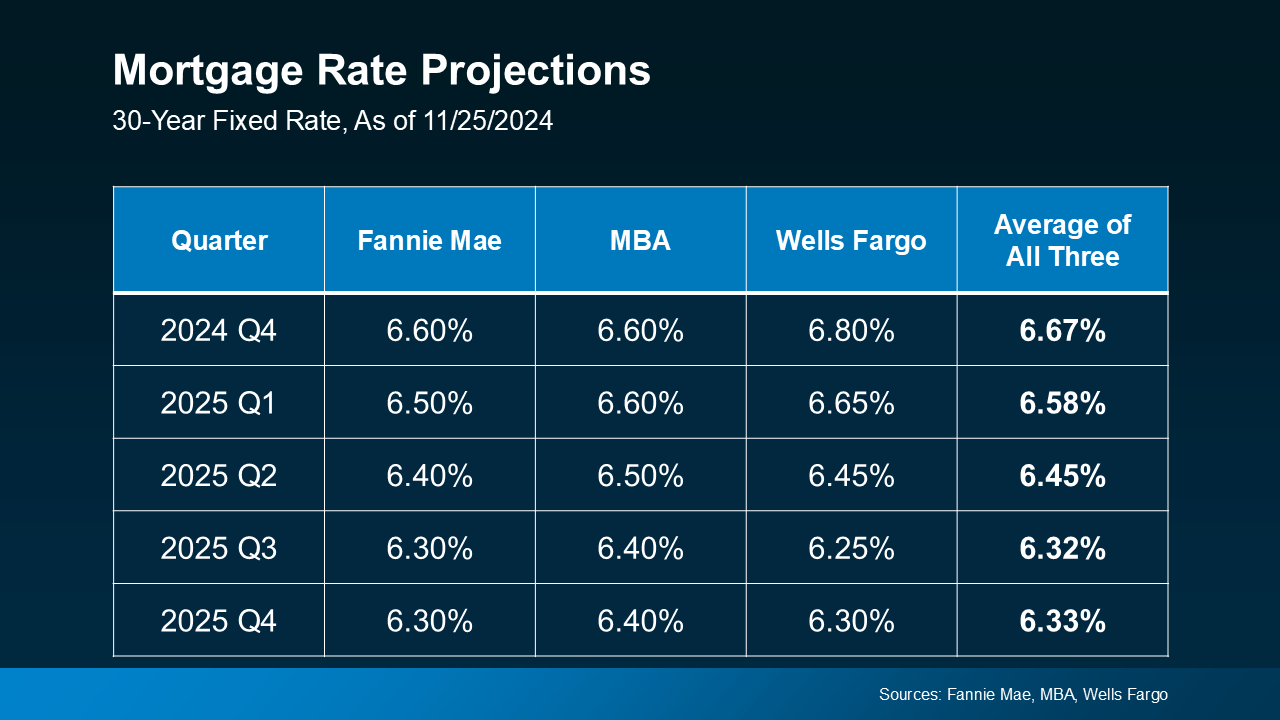

And the other experts agree. They’re forecasting rates could settle in the mid-to-low 6% range by the end of the year (see chart below):

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

A trusted lender and an agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your bottom line. With their help, you’ll see even a small decline can help bring down your future mortgage payment.

Will Home Prices Fall?

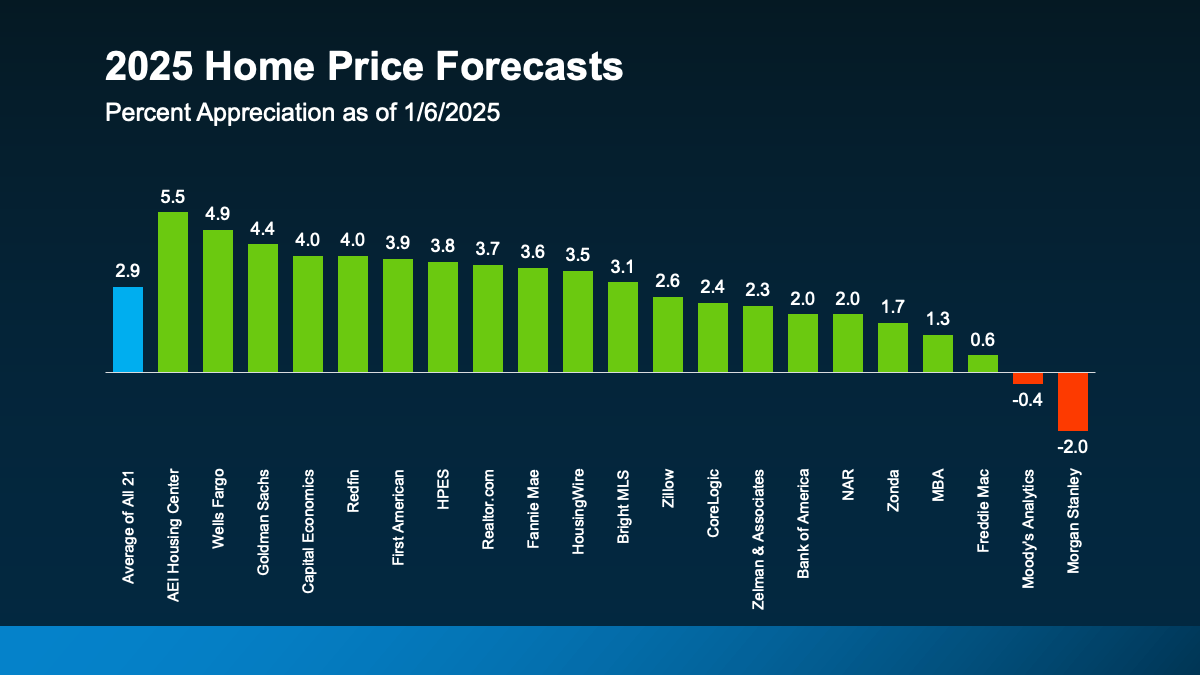

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – just at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. And that’s a much more typical and sustainable rise in prices (see graph below):

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

And if you’re wondering how it’s even possible prices are still rising, here’s your answer. It all comes down to supply and demand. Even though there are more homes for sale now than there were a year ago, it’s still not enough to keep up with all the buyers out there. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind, though, the housing market is hyper-local. So, this will vary by area. Some markets will see even higher prices. And some may see prices level off or even dip a little if inventory is up in that area. In most places though, prices will continue to rise (as they usually do).

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends and what they mean for your plans.

Bottom Line

The housing market is always shifting, and 2025 will be no different. With rates likely to ease a bit and prices rising at a more normal and sustainable pace, it’s all about staying informed and making a plan that works for you.

Let’s connect so you can get the scoop on what’s happening in our area and advice on how to make your next move a smart one.

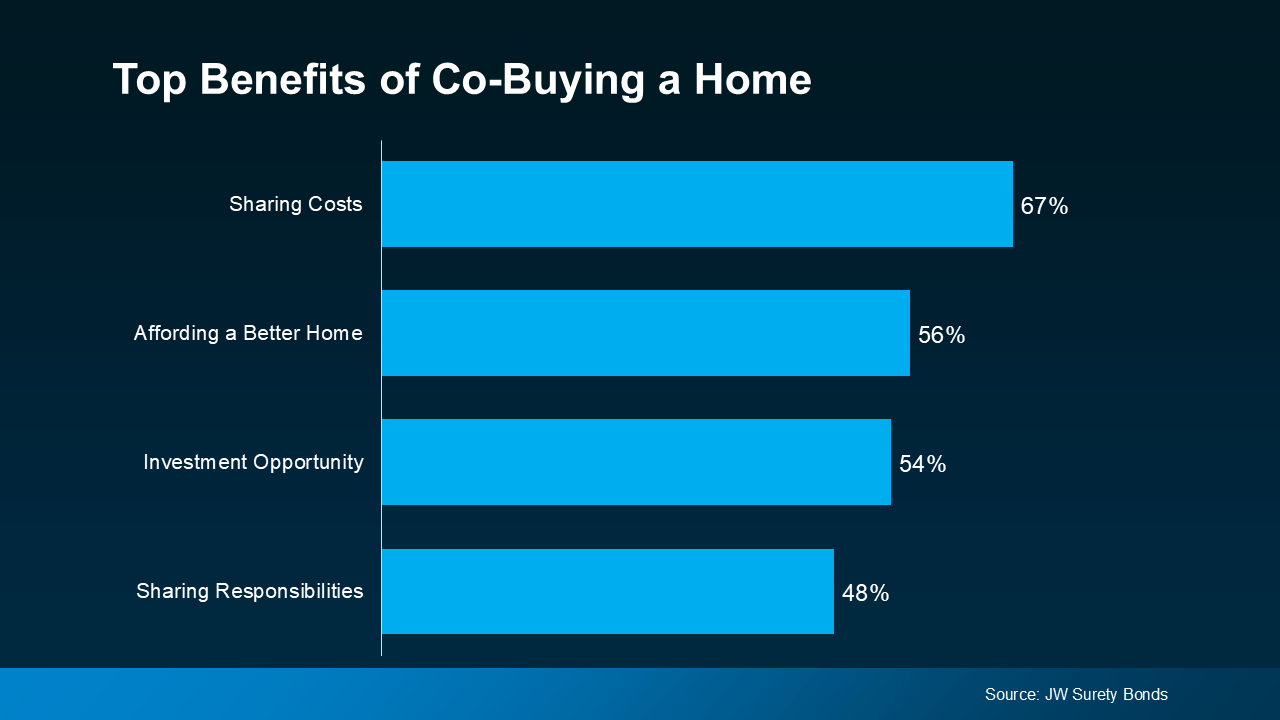

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.