A few years ago, homes were flying off the shelves and getting multiple offers well over their asking price. It felt like you could name your price and still have buyers lined up at the door.

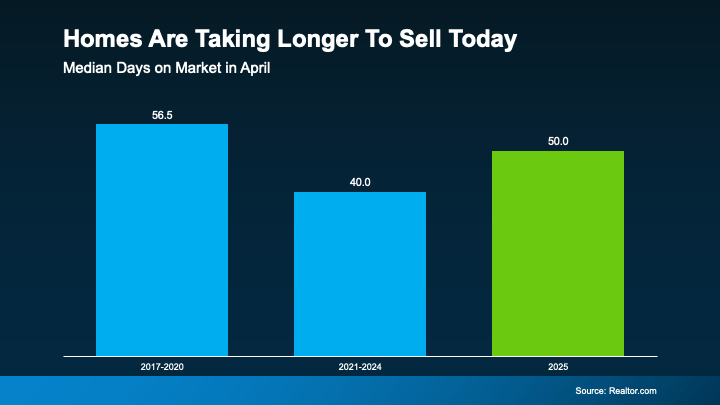

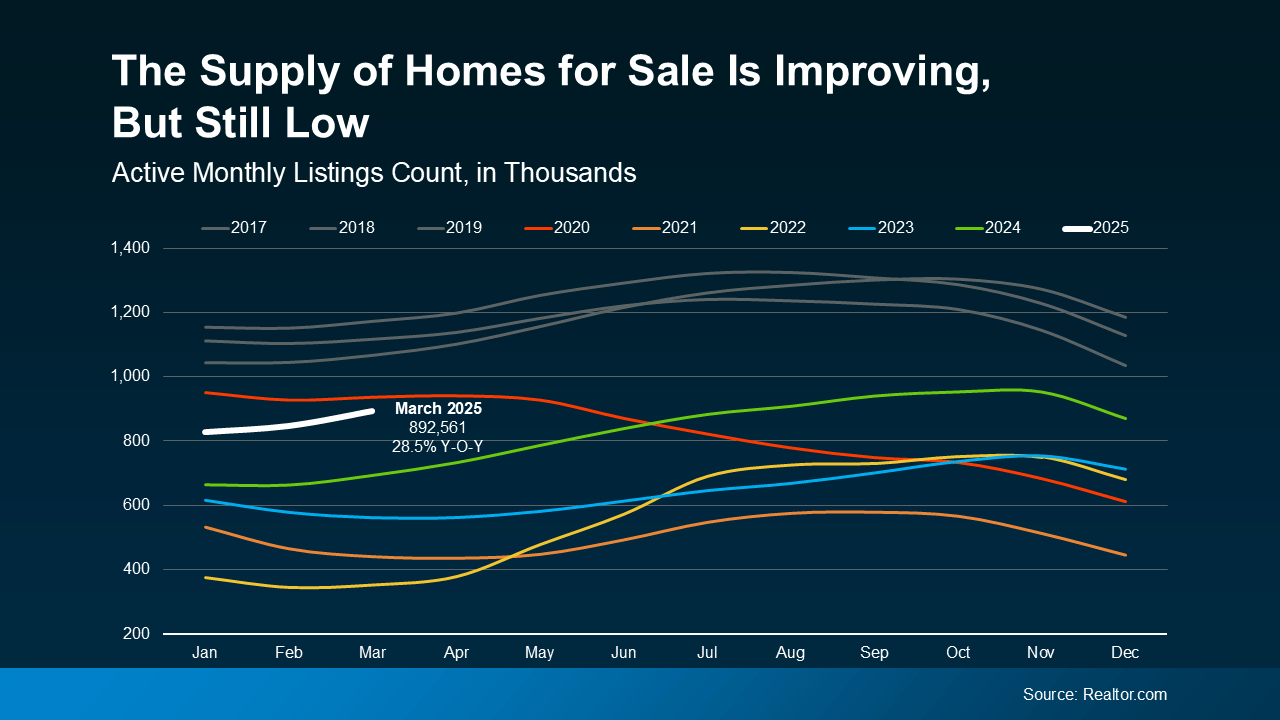

But today’s housing market is different. Buyers are getting more selective now that inventory has grown. Homes are sitting a little longer. And more sellers are having to cut their prices.

So, how do you still come out on top? It all starts with one thing, pricing your house right from the start. Today, that matters more than ever – and it can make or break your sale.

There’s a Real Price Disconnect Between Buyers and Sellers

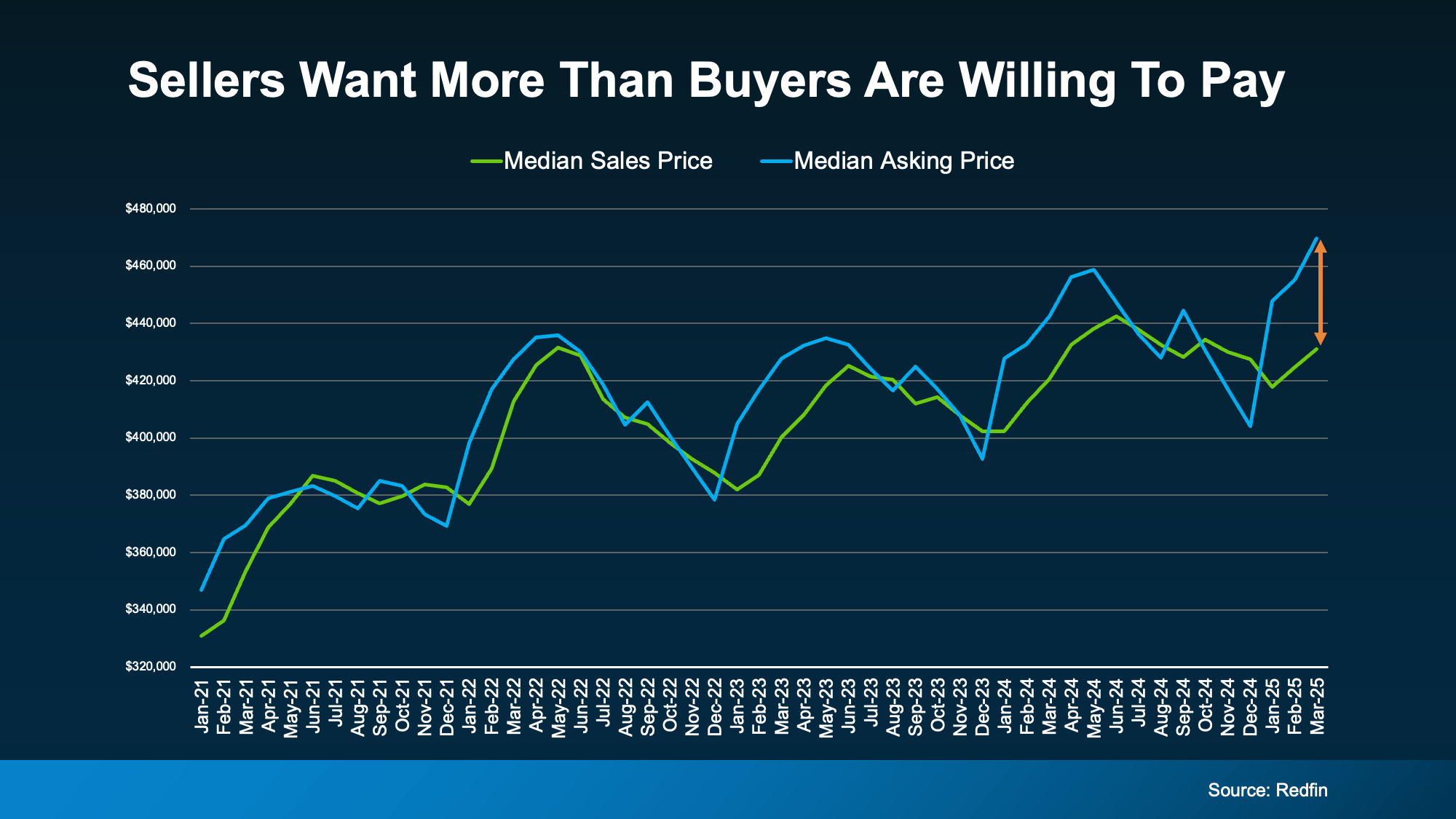

A recent survey from Realtor.com shows 81% of home sellers believe they’ll get their asking price or more. But the actual sales data shows there’s a growing gap between what sellers expect and what buyers are actually willing to pay.

In fact, an annual report from the National Association of Realtors (NAR) shows 44% of recently sold homes went for less than the asking price. And 1 in 3 sellers had to cut their price at least once before the home sold. It’s a sign that expectations may be a little out of step with today’s reality.

Check out the graph below. It uses data from Redfin to show that asking prices (blue line) are higher than actual sales prices (green line) by a wider and wider margin:

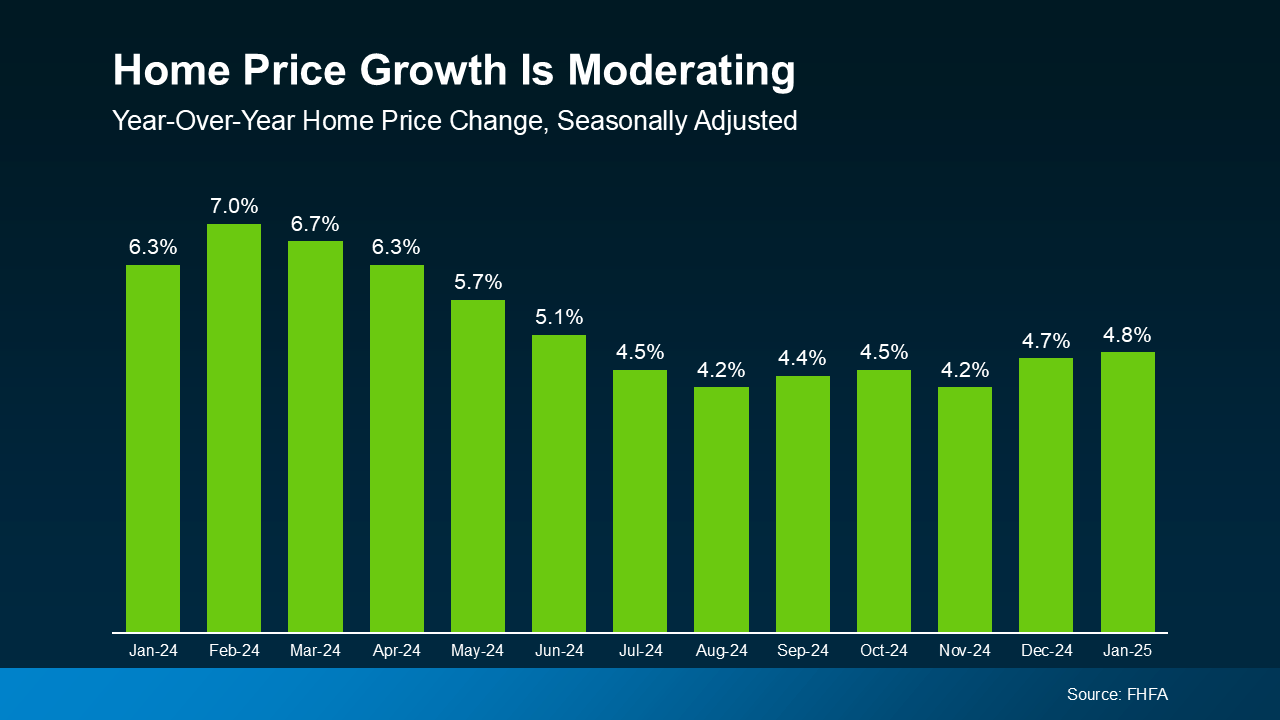

This tells you something important: not all buyers are willing to pay what many sellers are asking. That doesn’t mean you can’t sell for a great price – but it does mean you need to start with a price that reflects what people are willing to pay in today’s market.

This tells you something important: not all buyers are willing to pay what many sellers are asking. That doesn’t mean you can’t sell for a great price – but it does mean you need to start with a price that reflects what people are willing to pay in today’s market.

What Happens When You Overprice Your House?

Pricing your house high initially may seem like a smart move, so you have more room to negotiate. But the reality is, an overpriced home can sit on the market and turn buyers away.

Buyers are smart. And when they see a house that’s been sitting for a while, they start to wonder what’s wrong with it. That can lead to fewer showings, less interest, and eventually, a price cut to re-ignite attention. As Realtor.com explains:

“By getting the right price early on, you can increase the odds buyers will be interested in the home. In turn, this decreases the chances the home will sit on the market for a lengthier timeline, also reducing the odds you’ll need to lower the listing price.”

The longer a house sits, the harder it can be to sell.

You Still Have a Great Opportunity – If You Price Your House Right

To avoid making this mistake, it’s important to lean on an agent who knows what’s happening locally when you set your asking price.

Your agent will look at recent local sales, buyer trends, and inventory levels to find that pricing sweet spot for your neighborhood – because it’s going to be different based on where you live.

And here’s something else to keep in mind, home prices have climbed more than 57% over the past five years. So, even if you price a bit below the number you had your sights set on, you’ll likely still be in a great position profit-wise.

With a local real estate agent’s help, you’ll attract more attention, avoid seeing your house sit on the market too long, and maximize your chances of getting a strong offer.

In today’s market, the right price works. As Mike Simonsen, Founder of Altos Research, explains:

“. . . the best properties, well priced are selling quickly in most of the country.”

Bottom Line

The market has changed, but your opportunity to sell hasn’t. You just need the right pricing plan. Let’s walk through what’s happening with prices in our area and determine what price would help your house sell quickly and for top dollar.