Benjamin Franklin famously stated that “in this world, nothing is certain except death and taxes.” While his words still ring true, there’s another unavoidable reality in modern life: rising costs. From groceries to energy bills, the cost of living continues to climb, and one of the biggest contributors to this is housing.

Housing has always been a major expense for individuals and families, but recent data highlights just how burdensome it can be. According to an article released in September 2024, renters spent a median of 31.0% of their income on housing costs, while homeowners with a mortgage spent 21.1%, and those without a mortgage spent just 11.5%. Despite this, 18.8 million homeowners were still dedicating more than 30% of their income to housing expenses, illustrating that affordability remains a challenge for many.

The long-term trends in housing costs are equally telling. According to the Federal Reserve Economic Data, rent increases have averaged 3.88% annually over the past 60 years, outpacing the average inflation rate of 3.7% during the same period. Meanwhile, the median home has appreciated at an average annual rate of 5.56%, showing that homeownership not only shields against rising rents but also builds wealth over time.

The financial benefits of homeownership extend far beyond escaping annual rent hikes. The latest Federal Reserve Board Survey of Consumer Finance reveals that median homeowners have 38 times the household wealth of renters. This wealth disparity underscores the power of owning a tangible asset like a home, which appreciates in value and provides stability in a world of ever-increasing costs.

While rising home prices and higher mortgage rates may deter some from entering the housing market, it’s important to consider the long-term financial advantages of homeownership. Waiting on the sidelines, hoping for prices or rates to drop significantly, could mean missing out on years of equity growth and continued rent hikes.

A significant factor influencing today’s housing decisions is mortgage rates. The historically low rates seen before the pandemic were an anomaly, not the norm. The 52-year Freddie Mac average for 30-year fixed-rate mortgages is 7.74%, which is much closer to the rates we’re seeing today. For prospective buyers, accepting the current rates as the “new normal” is key to moving forward and securing the long-term benefits of homeownership.

While some individuals are genuinely priced out of the housing market, many are financially capable of purchasing a home but are hesitant due to uncertainty. However, delaying a purchase means continuing to pay rising rents and missing out on the wealth-building potential of owning a home. Even at current rates, the long-term advantages of homeownership, including equity growth, tax benefits, and protection against inflation, ar outweigh the costs of waiting.

Death, taxes, and rising costs are life’s unavoidable truths, but how you navigate them can shape your financial future. Housing represents one of the most significant expenses for individuals and choosing to own rather than rent can make a profound difference in wealth accumulation and financial security.

While mortgage rates and home prices may feel intimidating, they reflect a long-term norm rather than an exception. For those who can afford to buy now, stepping into the market could be the key to securing stability and wealth in an uncertain world. Don’t let hesitation hold you back from building a solid foundation for your future.

Download the Homeowners Tax Guide.

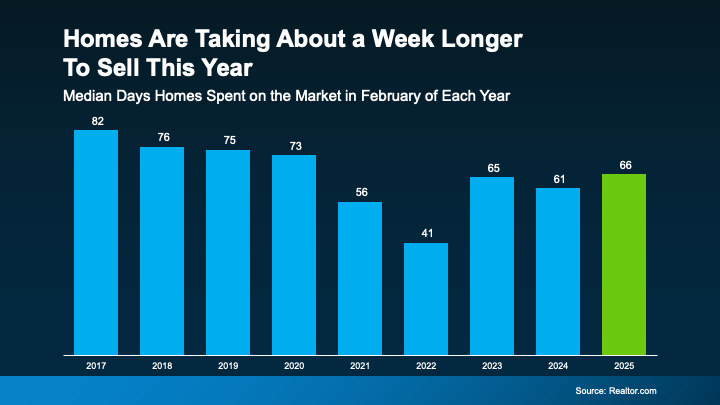

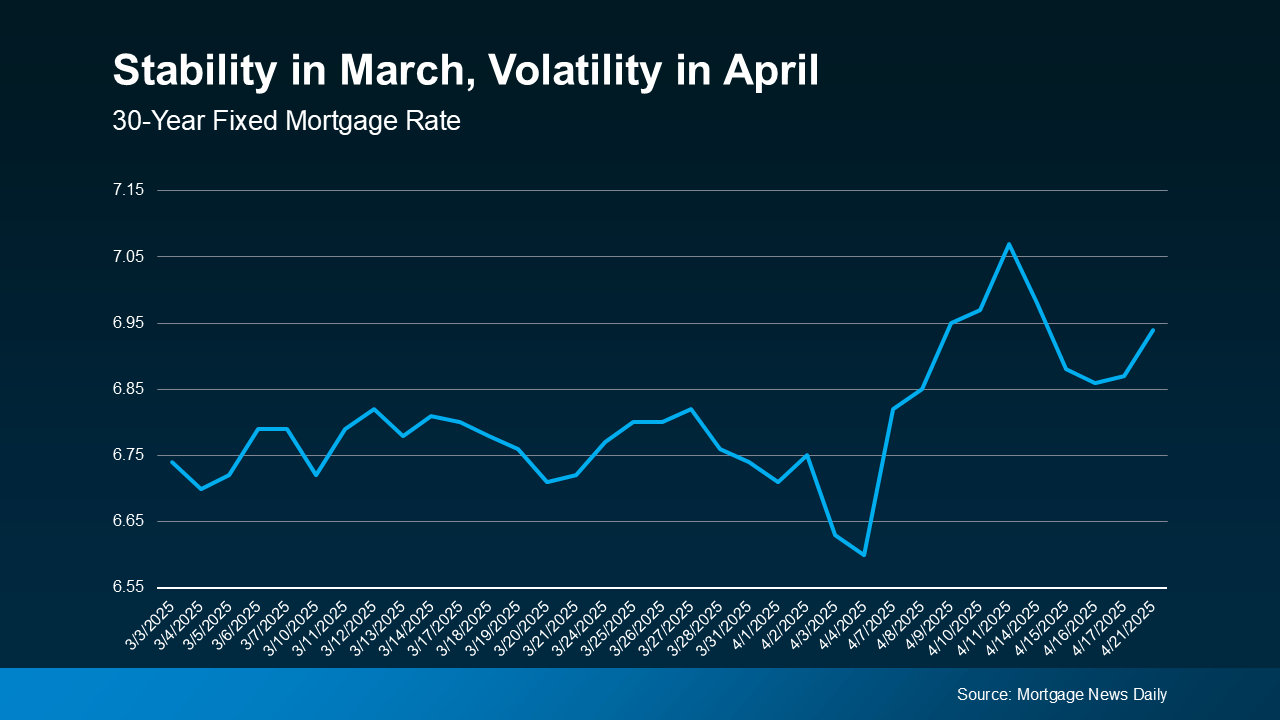

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.

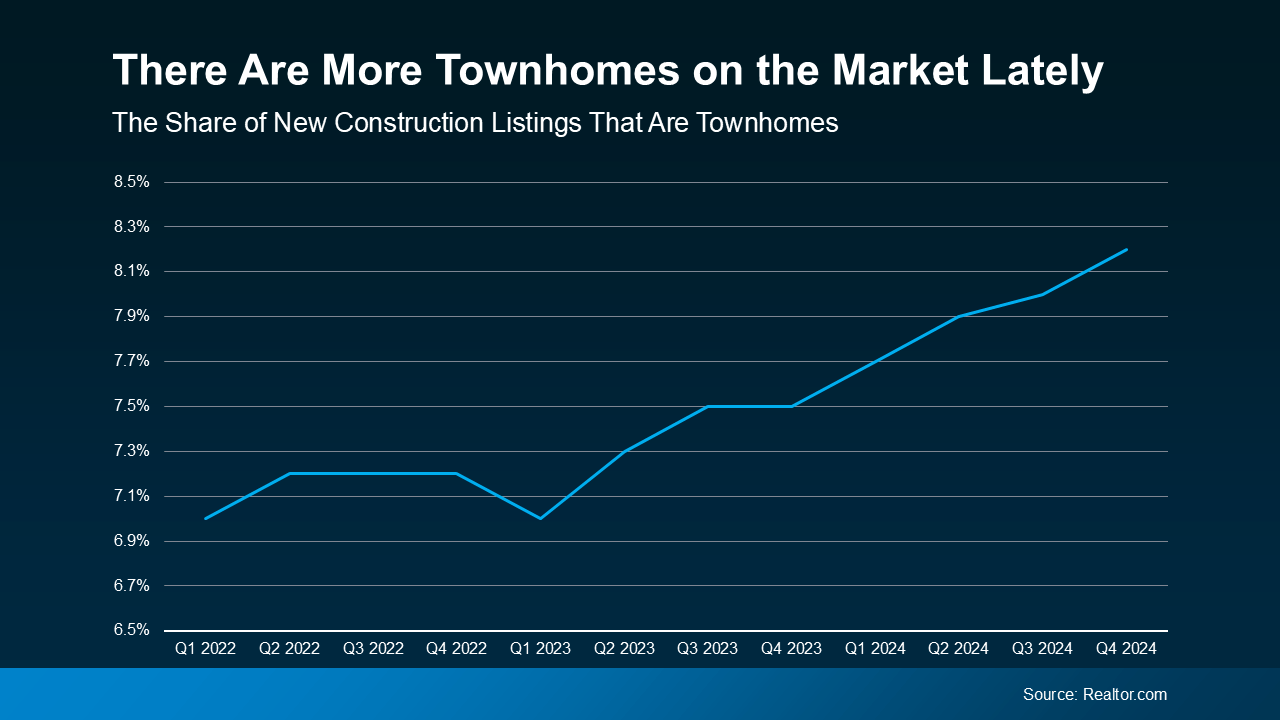

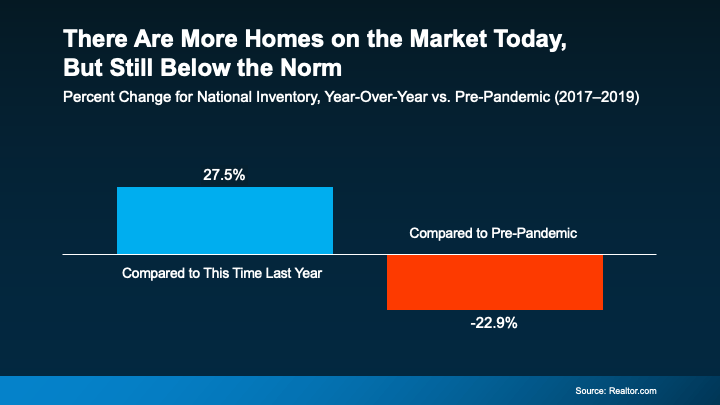

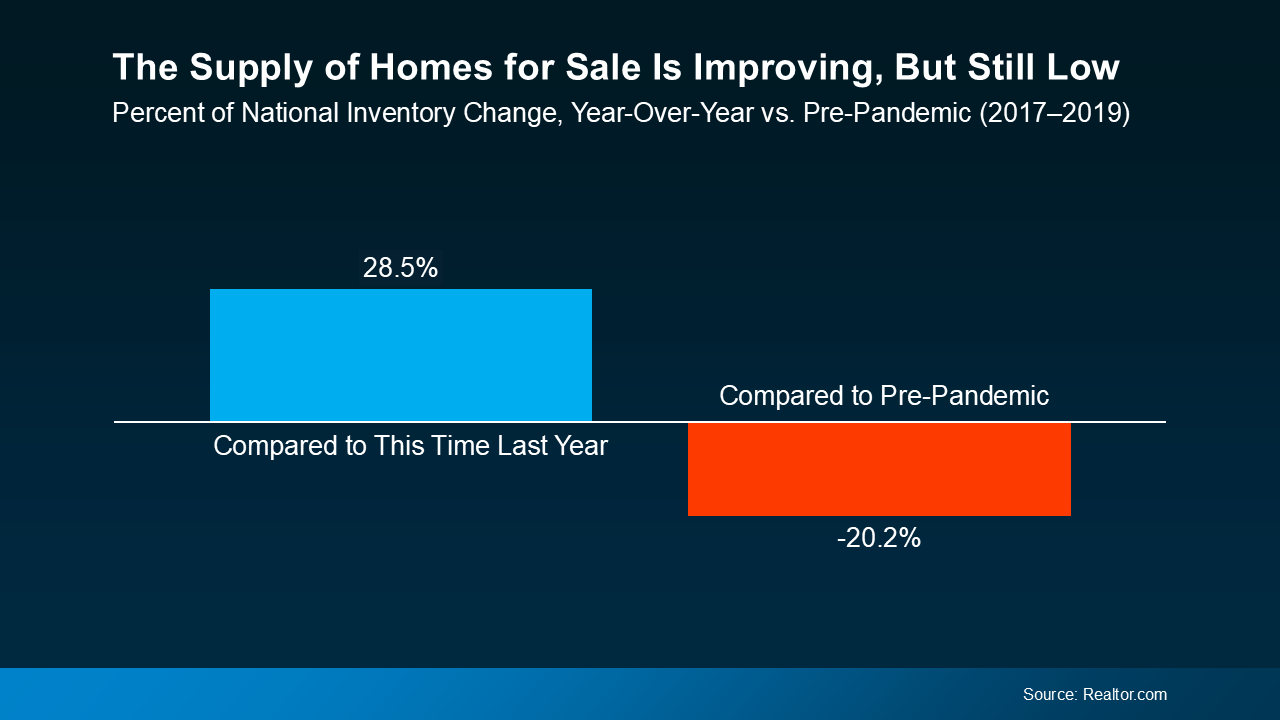

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs.