When interviewing real estate agents to sell your home, asking the right questions is key to finding an agent who will best meet your needs. The process of selling a home can be complex, and the right agent will not only have the experience and market knowledge but also the right approach to guide you through every step.

By asking insightful questions, you can gauge an agent’s expertise, communication style, and understanding of your goals, ultimately helping you choose someone who will work tirelessly to achieve the best possible outcome for you.

Here are 25 common questions homeowners often ask when interviewing a real estate agent to sell their home:

- What is your experience in real estate, and how long have you been working in this area?

- How many homes have you sold in the past year?

- What is your average sale-to-list price ratio?

- How familiar are you with my neighborhood?

- How do you determine the listing price for a home?

- What are the current market trends, and how will they impact my home’s sale?

- Can you provide references from past clients?

- What is your marketing strategy to sell my home?

- Do you use professional photography, staging, or virtual tours?

- Will you host open houses? If so, how many and when?

- How will you keep me updated throughout the selling process?

- What online platforms and social media channels will you use to promote my home?

- What do you think are the unique selling points of my home?

- How do you handle multiple offers?

- What is your strategy for negotiating the best price for my home?

- What is your commission rate, and what services does that include?

- Are there any additional fees I should be aware of?

- What steps do I need to take to prepare my home for sale?

- How long do you expect it will take to sell my home?

- What challenges do you anticipate in selling my home?

- Can you provide a comparative market analysis (CMA) for my home?

- How do you handle a situation where my home isn’t getting offers?

- What happens if I’m not satisfied with your service? Can I cancel the contract?

- Do you work alone, or do you have a team?

- What sets you apart from other agents? Why should I choose you?

Answers to these questions will help homeowners understand an agent’s expertise, marketing approach, negotiation skills, and overall fit with their needs. For more information, download our Sellers Guide.

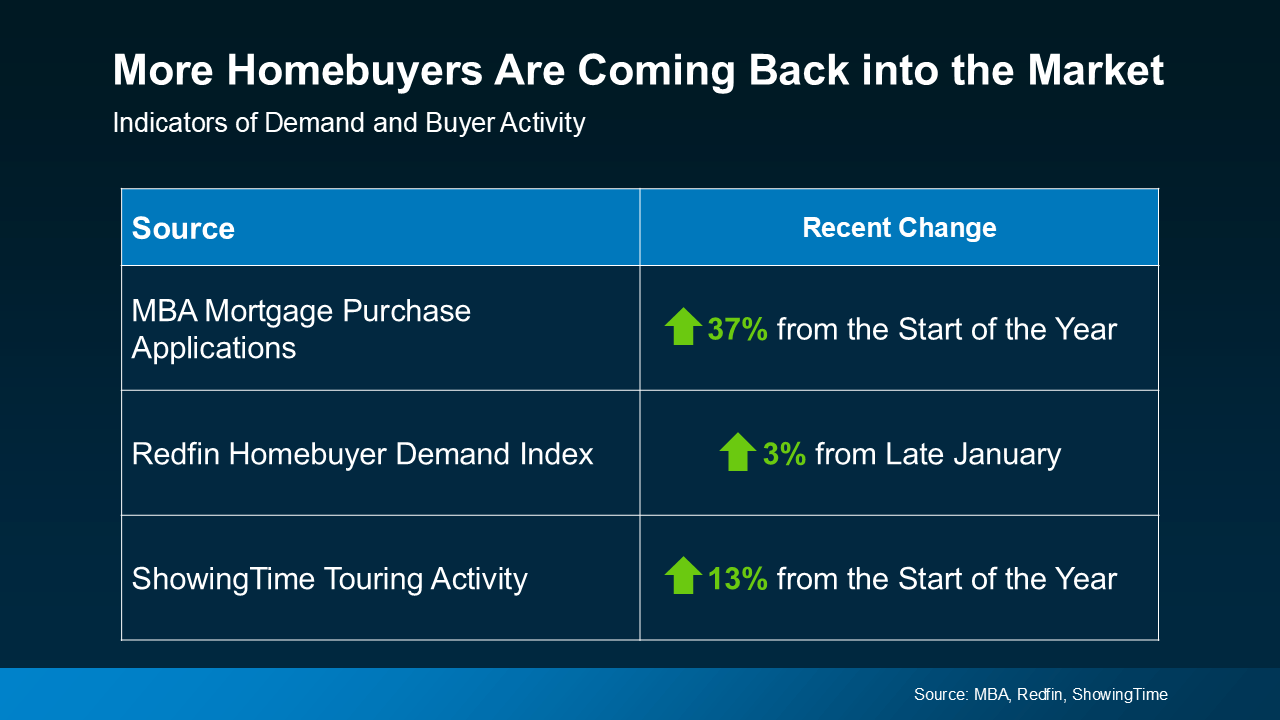

Where the Market Stands Now

Where the Market Stands Now Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

What This Means for You

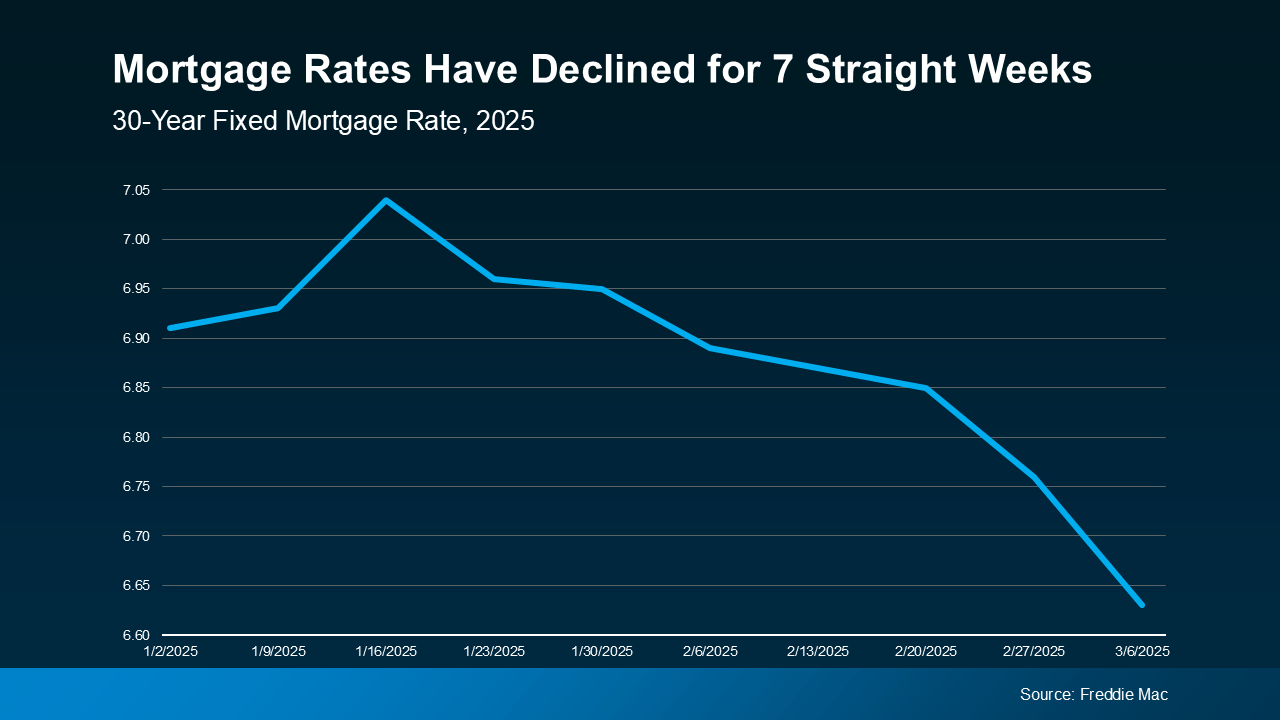

What This Means for You Why Aren’t Prices Dropping? It’s All About Supply and Demand

Why Aren’t Prices Dropping? It’s All About Supply and Demand