Last year, 70% of buyers abandoned their home search – and maybe you were one of them. It makes sense. Inventory was low, prices were high, and mortgage rates were up and down like a rollercoaster. All of that made it really hard to find a home you loved – and could afford.

But guess what? The market is shifting.

So, if you paused your moving plans in 2024, it might be time to hit play again. Here’s why.

More Inventory Opens Up More Options

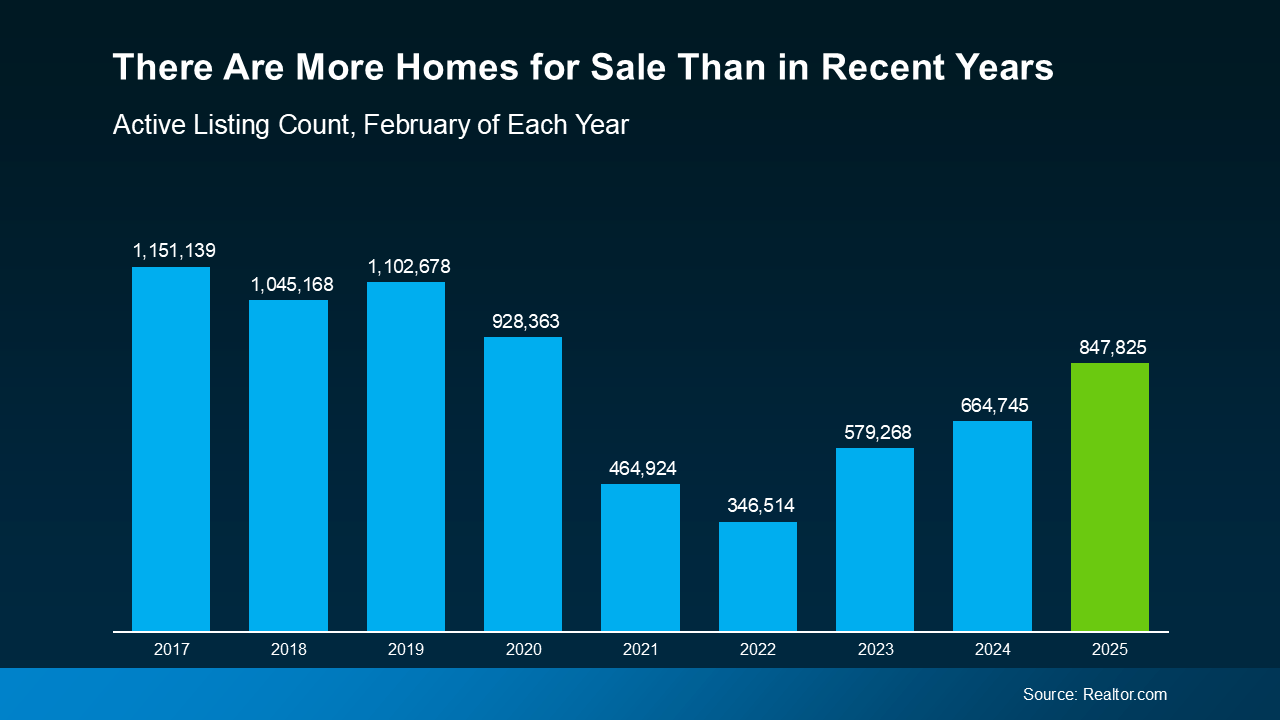

Even if you could make the numbers work, the lack of available homes in recent years probably made it hard to come by something that fit your needs. But inventory is rising, which means you have more options now.

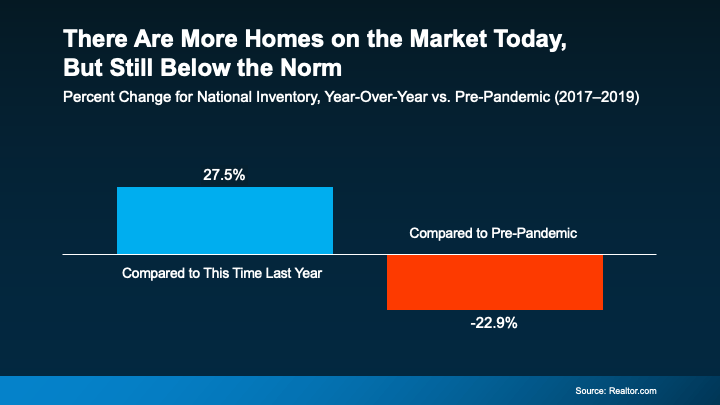

According to Realtor.com, inventory has jumped 27.5% since this time last year (see graph below):

So, if you were reluctant to list your house because you weren’t sure where you’d go if it sold, you have more choices than you did a year ago. That’s a big win.

So, if you were reluctant to list your house because you weren’t sure where you’d go if it sold, you have more choices than you did a year ago. That’s a big win.

Homes Are Staying on the Market Longer, Too

When the supply of homes for sale is low, they’re snatched up quickly because there just aren’t enough of them to go around. And a few years ago, that meant your house could sell overnight. While that’s not always a bad thing, if you’re planning a move and also need to find your next home, a slower pace isn’t the end of the world. In fact, it’s welcome relief.

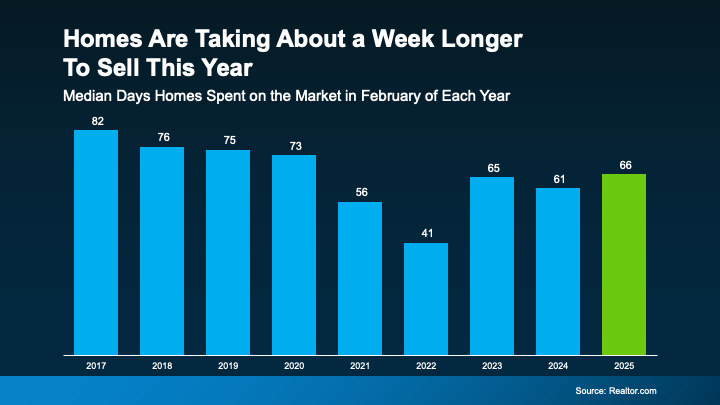

Now that inventory has grown, homes are staying on the market longer, meaning you don’t have to feel as rushed in the process (see graph below):

The latest data shows the typical time homes spent on the market went up by about 8% this year – that’s higher than we’ve seen since 2020, but still a faster pace than before the market ramped up. And it’s about a week longer than last year. Talk about a sweet spot for movers. It may seem like just a few days, but it gives you more flexibility and time to be thoughtful about your decisions. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, notes:

The latest data shows the typical time homes spent on the market went up by about 8% this year – that’s higher than we’ve seen since 2020, but still a faster pace than before the market ramped up. And it’s about a week longer than last year. Talk about a sweet spot for movers. It may seem like just a few days, but it gives you more flexibility and time to be thoughtful about your decisions. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, notes:

“There are more homes for sale than in the last few years, which means the market pace is a bit more manageable–with longer days on market–and many sellers are more flexible . . . Though buyers face still-high housing costs, they may find a bit more give in the market, which could give them more time to make a decision, even in the busy spring and summer months.”

And if you’re thinking – but wait – doesn’t that mean it will be harder to sell my house? Don’t worry. With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling, especially as more buyers step back into the game this season.

Bottom Line

With growing inventory, sellers who want to upgrade, downsize, or relocate have more choices. Plus, with less pressure to rush into an offer, it could be a great time to revisit your home search if you’ve put it on hold.

With more homes on the market and more time to make decisions, what else do you need to see in order to kickstart your home search again? Let’s talk about what’s happening in our local market right now.buyingbuying

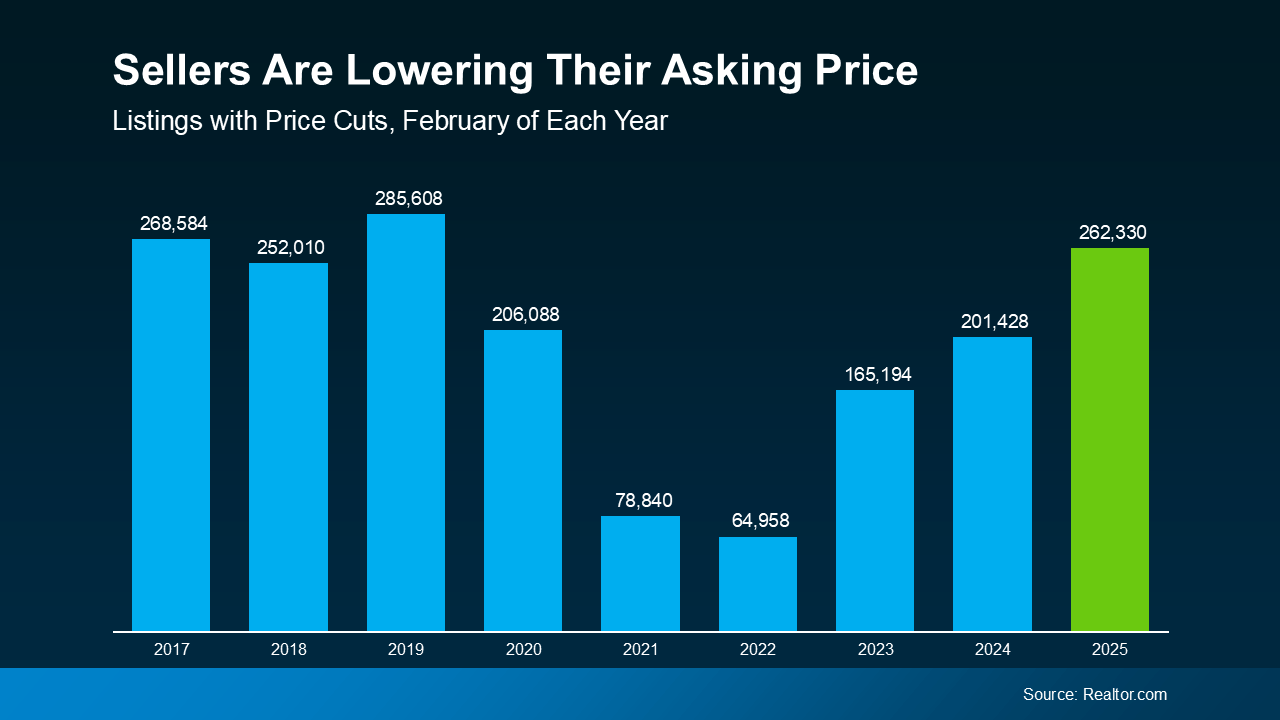

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a big relief.

Where the Market Stands Now

Where the Market Stands Now Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.