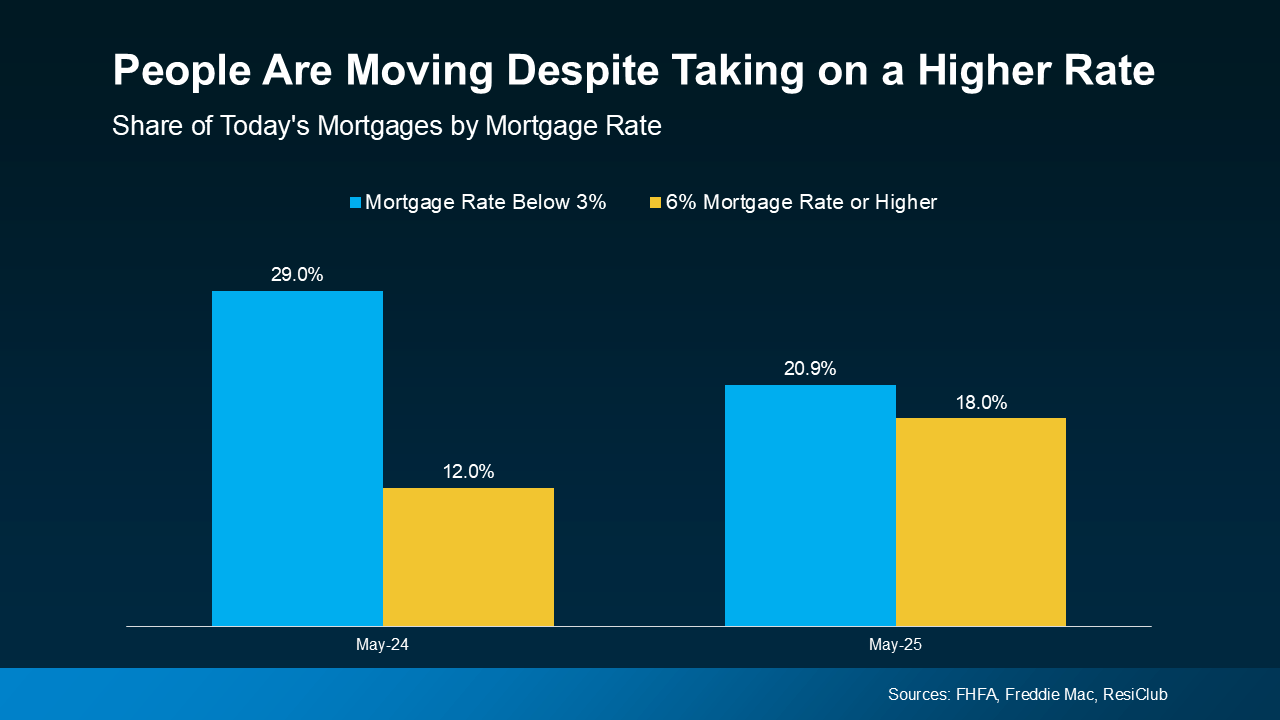

In today’s high-interest-rate environment, homebuyers are looking for every possible advantage to secure an affordable mortgage. One often-overlooked opportunity is assuming an existing FHA or VA loan, especially those issued in the past few years when interest rates were at historic lows.

In today’s high-interest-rate environment, homebuyers are looking for every possible advantage to secure an affordable mortgage. One often-overlooked opportunity is assuming an existing FHA or VA loan, especially those issued in the past few years when interest rates were at historic lows.

An assumable loan allows a qualified buyer to take over the seller’s existing mortgage, including its remaining balance, interest rate, and repayment terms. FHA and VA loans are generally assumable, but buyers must meet the lender’s qualification standards, just like they would for a new mortgage.

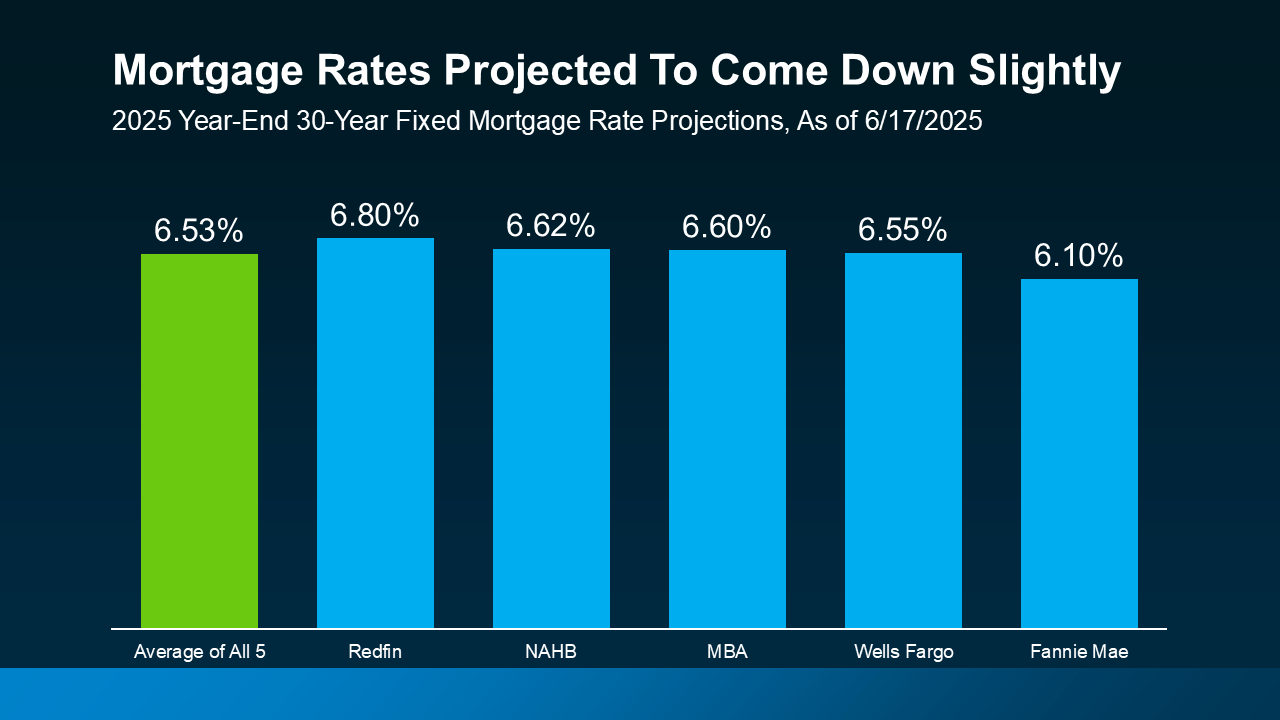

With interest rates currently much higher than they were just a few years ago, assuming a loan that carries a lower-than-market interest rate can be a game-changer for buyers. Here are some key advantages:

Lower Interest Rate = Lower Monthly Payments – If the seller’s mortgage has an interest rate of 3% or 4%, assuming the loan means immediate savings compared to today’s rates, which are often above 6% or 7%. A lower rate can translate into hundreds of dollars in savings each month.

Lower Closing Costs – Unlike taking out a new mortgage, assuming an existing loan typically comes with reduced lender fees and fewer closing costs, saving the buyer thousands at the closing table.

No Need for an Appraisal – Since the buyer is taking over an existing mortgage, there’s often no need for a new appraisal, reducing both costs and potential delays in the transaction.

More of Your Payment Goes Toward Principal – Because the loan is further into its amortization schedule, a higher percentage of each payment goes toward paying down the principal rather than just interest, building equity faster.

One of the biggest hurdles with loan assumptions is that the seller’s remaining loan balance may be significantly lower than the home’s purchase price. This means the buyer must cover the difference between the sale price and the outstanding loan balance.

For example, a home is selling for $400,000 with the seller’s assumable FHA loan balance is $300,000, the buyer needs to bridge the $100,000 gap between the sale price and the assumed loan.

If a buyer doesn’t have enough cash to cover this gap, there are financing options:

- Second Lien Financing … If the buyer puts down at least 10%, they may qualify for a second mortgage to cover the remaining difference. This could come from a conventional lender or even through owner financing.

- Home Equity Loans or HELOCs … If the buyer can arrange temporary funding to close the assumption, they may be able to get a home equity loan or line of credit to fund the difference once the property is closed and in their name.

Navigating the Loan Assumption Process

While any FHA- or VA-approved lender can originate new loans, assumptions must be processed through the current loan servicer. Some lenders may not be familiar with the process and could discourage assumptions due to lower fees and longer processing times.

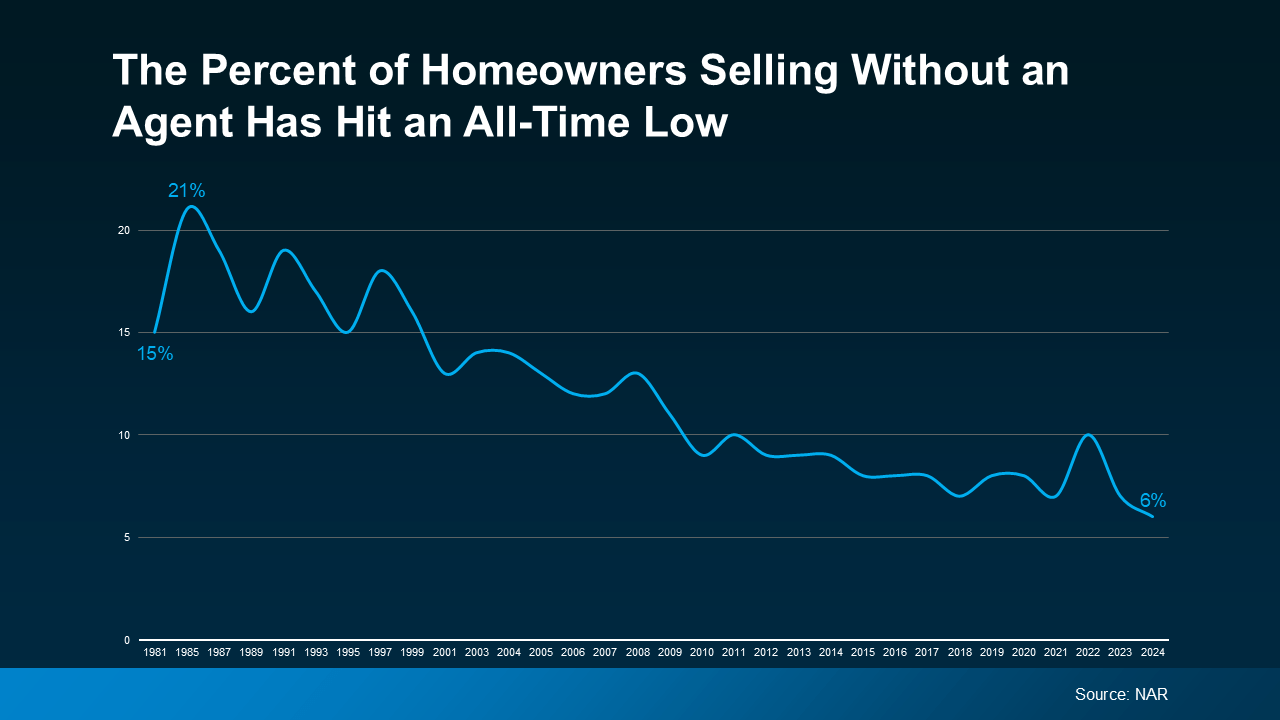

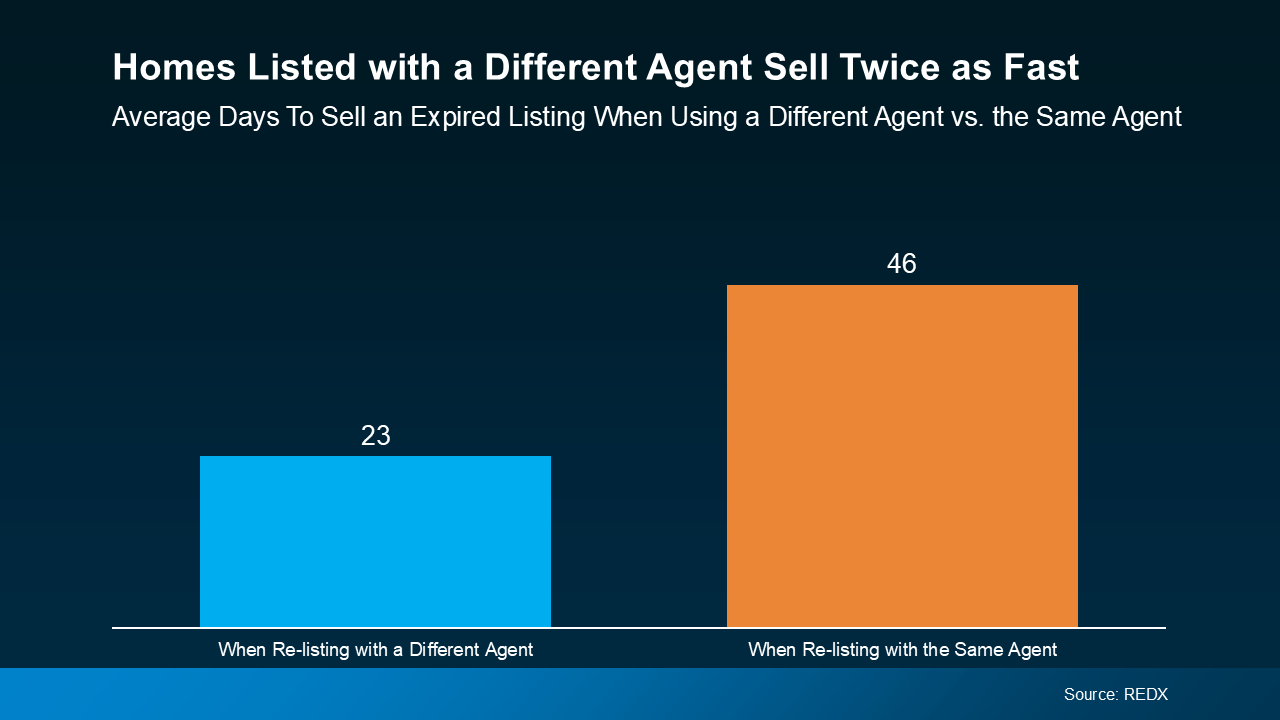

Buyers should be persistent if a lender is uncooperative, request to speak with someone who understands loan assumptions. It is to a buyers’ advantage to work with a knowledgeable agent who is experienced with assumptions and can help negotiate financing solutions and streamline the process.

If you’re a buyer looking for lower payments in today’s market, an FHA or VA loan assumption could be an excellent opportunity. While it requires careful planning to cover the price difference, the long-term savings from a lower interest rate can make a significant impact.

Thinking about assuming a loan or selling a home with an assumable mortgage? Let’s discuss how this strategy could work for you!

4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

The Big Picture

The Big Picture

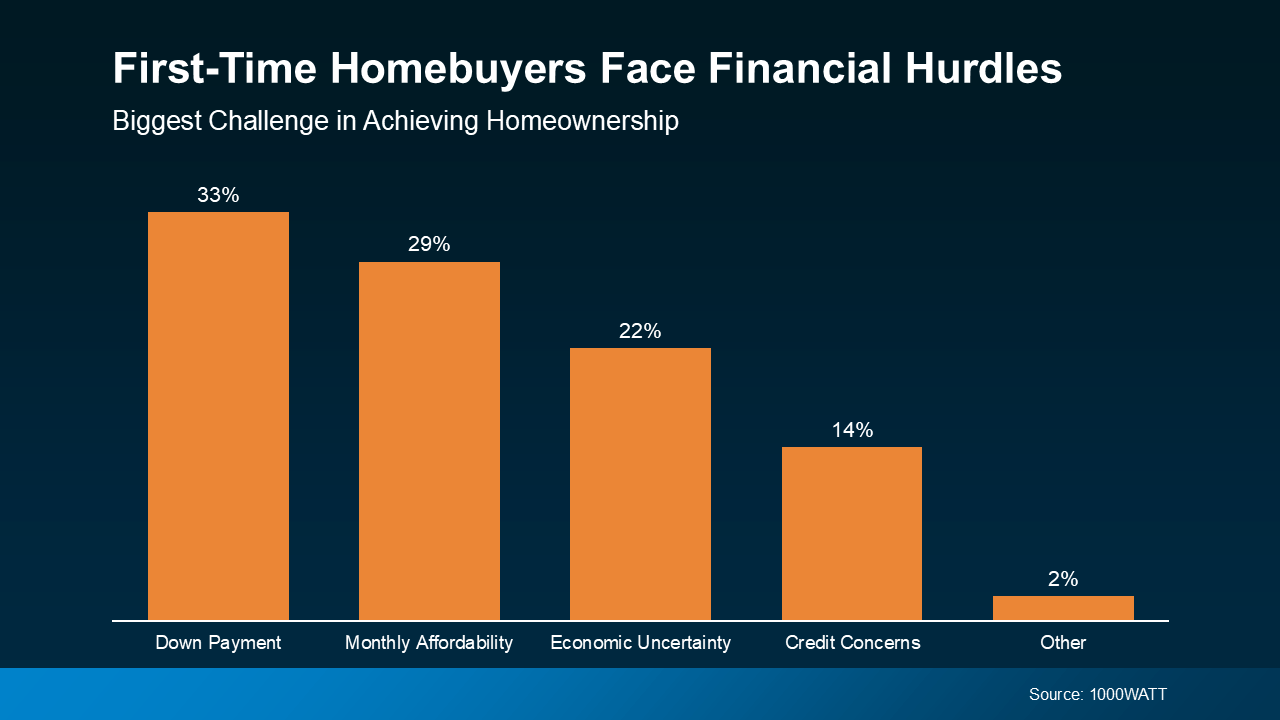

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.